GDP Growth Forecasts 2025: Which European Economies Will Have the Highest Growth

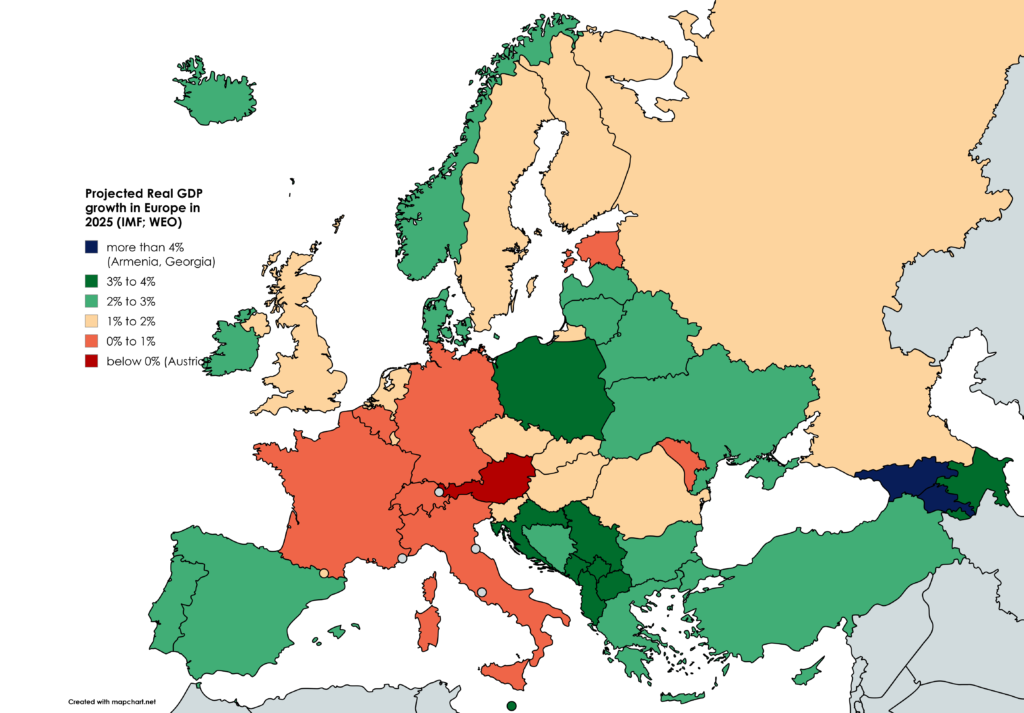

The latest GDP growth forecasts 2025 European economies point to a diverse economic outlook across the continent, with some countries projected to outperform their peers in terms of expansion while others face more modest prospects. According to Euronews, updated economic forecasts from the International Monetary Fund (IMF) and the European Commission highlight which nations are set to lead growth and how structural factors and policy responses will shape performance. This analysis presents a comprehensive overview of the latest projections, explaining what this means for businesses, policymakers, and citizens across Europe. (euronews.com)

Understanding GDP growth forecasts 2025 European economies is critical for economic planning, investment decisions, and assessing the competitive dynamics within the European Union and the broader region.

What Are GDP Growth Forecasts and Why They Matter

Gross Domestic Product (GDP) is the total value of goods and services produced in an economy over a specific period. Forecasts project future economic performance, taking into account variables such as consumer demand, investment, government spending, inflation, and global conditions.

Forecasts for 2025 are especially relevant as economies continue to navigate post-pandemic recovery, geopolitical uncertainties, and structural shifts in labour markets and technology.

For a detailed explanation of how GDP is calculated and why GDP forecasts are essential, refer to the World Bank GDP Definition and Use (External resource: World Bank – GDP Definition — https://www.worldbank.org/en/publication/gdp-and-economic-performance)

European Economies Expected to Lead in 2025 Growth

According to recent forecasts cited by Euronews, several European economies are expected to outperform regional peers in terms of GDP growth in 2025. Differences in growth trajectories reflect variations in investment, demographic trends, industrial strength, and structural reforms.

Ireland

-

Ireland is frequently highlighted as one of the fastest-growing economies in Europe.

-

Strong performance is driven by sustained foreign direct investment, a thriving tech sector, and exports.

-

While Ireland’s small size makes it more volatile, its favorable tax regime and business environment contribute to projected robust growth.

Poland

-

Poland is forecasted to register strong growth relative to many Western European economies.

-

Its large domestic market, diversified industrial base, and investment in infrastructure support expansion.

-

Resilience in labour markets and increasing automation are also cited as growth drivers.

Spain

-

Spain’s economy is expected to benefit from robust tourism recovery, increased consumer spending, and structural reforms.

-

Continued investment in renewable energy and digital infrastructure further supports Spain’s growth prospects.

Other Notable Performers

Countries such as Romania, Hungary, and the Czech Republic are also forecasted to post above-average growth, driven by industrial output, export markets, and improving investment climates.

By contrast, larger economies like Germany and France are expected to see more moderate growth rates due to structural challenges such as aging populations and slower productivity improvements.

For broader comparative data on economic performance across Europe, the OECD Economic Outlook provides extensive analysis. (External resource: OECD Economic Outlook — https://www.oecd.org/economic-outlook)

Key Drivers of Growth in 2025

Several cross-cutting factors are shaping the GDP growth forecasts 2025 European economies:

Technology and Innovation

Investment in research and development, digitalisation, and high-tech industries supports productivity gains and competitiveness.

Tourism and Services

Countries reliant on tourism, such as Spain and Greece, continue to benefit from the rebound in international travel post-pandemic.

Domestic Demand

Strong consumption and labour markets drive demand for goods and services, contributing to sustained economic momentum in some economies.

EU Recovery Funds

Structural and investment funds from the NextGenerationEU recovery programme provide fiscal support for infrastructure, digitalisation, and sustainable transitions. For insight into how these funds influence growth, see the European Commission Recovery Plan (External resource: NextGenerationEU Overview — https://commission.europa.eu/strategy-and-policy/recovery-plan-europe_en)

Challenges Facing European Economies in 2025

Despite positive growth projections, multiple challenges could dampen performance for some countries:

Energy Market Uncertainties

Continued volatility in global energy markets can affect production costs and inflation.

Geopolitical Risks

Ongoing geopolitical tensions may disrupt trade flows and investor confidence.

Supply Chain Pressures

Manufacturing and logistics sectors may face continued constraints, particularly in high-tech and automotive industries.

Demographic Shifts

Ageing populations in Western Europe present long-term challenges to labour supply and social welfare systems.

These headwinds underscore the need for policy responsiveness and adaptive economic strategies.

Implications for Investors and Policymakers

For investors, understanding GDP growth forecasts 2025 European economies is essential for portfolio allocation and risk management. Growth-oriented sectors and high-performing countries offer potential opportunities, while more modest projections signal areas for caution.

Policymakers, meanwhile, can use these forecasts to:

-

Tailor fiscal policies to support growth and address structural bottlenecks

-

Invest strategically in innovation and human capital

-

Strengthen trade relations and market access

-

Implement reforms that enhance labour participation and productivity

For comprehensive data on national GDP statistics, the Eurostat GDP Statistics page serves as an authoritative reference. (External resource: Eurostat GDP by Country — https://ec.europa.eu/eurostat/statistics-explained/index.php?title=National_accounts_and_GDP)

Regional Breakdown: Northern vs Southern Europe

Growth patterns vary across Europe’s regions:

-

Northern Europe: Countries such as Ireland, Sweden, and the Baltic states are often positioned for stronger performance due to diversified economies and innovation ecosystems.

-

Southern Europe: Spain, Portugal, and Greece are benefiting from tourism and services, though structural reforms remain key to sustaining growth.

-

Central and Eastern Europe: Nations including Poland, Romania, and Hungary are leveraged for manufacturing and demographic advantages, translating into robust forecasts.

Understanding these regional dynamics provides context for relative performance and future growth potential.

The Broader Global Context

European growth forecasts should also be viewed in a global context. Emerging markets, US economic trends, and Asia’s growth trajectories influence European competitiveness through trade, investment, and financial flows.

Global institutions such as the International Monetary Fund (IMF) regularly publish comparative economic outlooks that contextualise Europe’s performance within global trends. (External resource: IMF World Economic Outlook — https://www.imf.org/en/Publications/WEO)

Conclusion

The GDP growth forecasts 2025 European economies paint a varied picture of economic prospects across the continent. While some nations are poised for strong expansion, others face enduring structural challenges. For investors, students of economics, and policymakers, these projections offer vital insights into future opportunities and risks.

Continued monitoring, strategic investment, and adaptive policy frameworks will be crucial to sustaining growth and navigating uncertainties in the years ahead.